There aren’t many industries that haven’t faced unprecedented challenges in the last few years. For some it has meant the need to either diversify or scale back production. For others, particularly in the metalwork manufacturing industry it has brought the need to do much more manufacturing in-house than before.

Outsourcing (or sub-contracting), although potentially expensive, has long been a part of our industry. Yet the more we reconnect with our industry colleagues, the more we discover they are starting to explore the possibility of bringing manufacturing in-house. And they are therefore looking at buying the metalwork machinery to do themselves, what they relied on others to do previously.

This is due to a variety of reasons.

Taking back control

Even the most efficient, well run business is at the mercy of factors it simply can’t control when using metalwork subcontractors. If those subcontractors are facing delays or have other priority work it will invariably then lead to delays for a business. The knock-on effects from this can often be a backlog of work building up. As well as overstocked warehouses and essentially, loss of business if the end product doesn’t reach the client in good time.

At a time when meeting expectations is vital, having in-house metalwork machinery to complete jobs from start to finish can help to exceed these. This can also help your business to stand out from the crowd.

A leaner, more organised approach

Processing and organising shipments from a metalwork subcontractor takes resources. When shipments might be more varied and less frequent or reliable, this may mean valuable time and manpower has to be spent locating parts. Or spent re-arranging jobs and the inevitable disruption to workflow and lead times.

Bringing the metalwork manufacturing process in-house does away with these problems in one fell swoop. Leaving a smooth and efficient workflow to be undertaken by your direct employees.

Saving time with flexibility

However hard we try, and however closely we manage the details, sooner or later the inevitable happens and a job goes wrong. Your assembly crew turns up to site and the part doesn’t fit. The holes don’t line up, or the specification has changed without the drawings being updated to suit. This means delays, sometimes even penalties…

If parts need to be returned, the impact can be costly. Yet if the work is done in-house, those delays might only be hours rather than the weeks. Especially with outsourced manufacturing that may be based at the other end of the country.

Regulating your costs

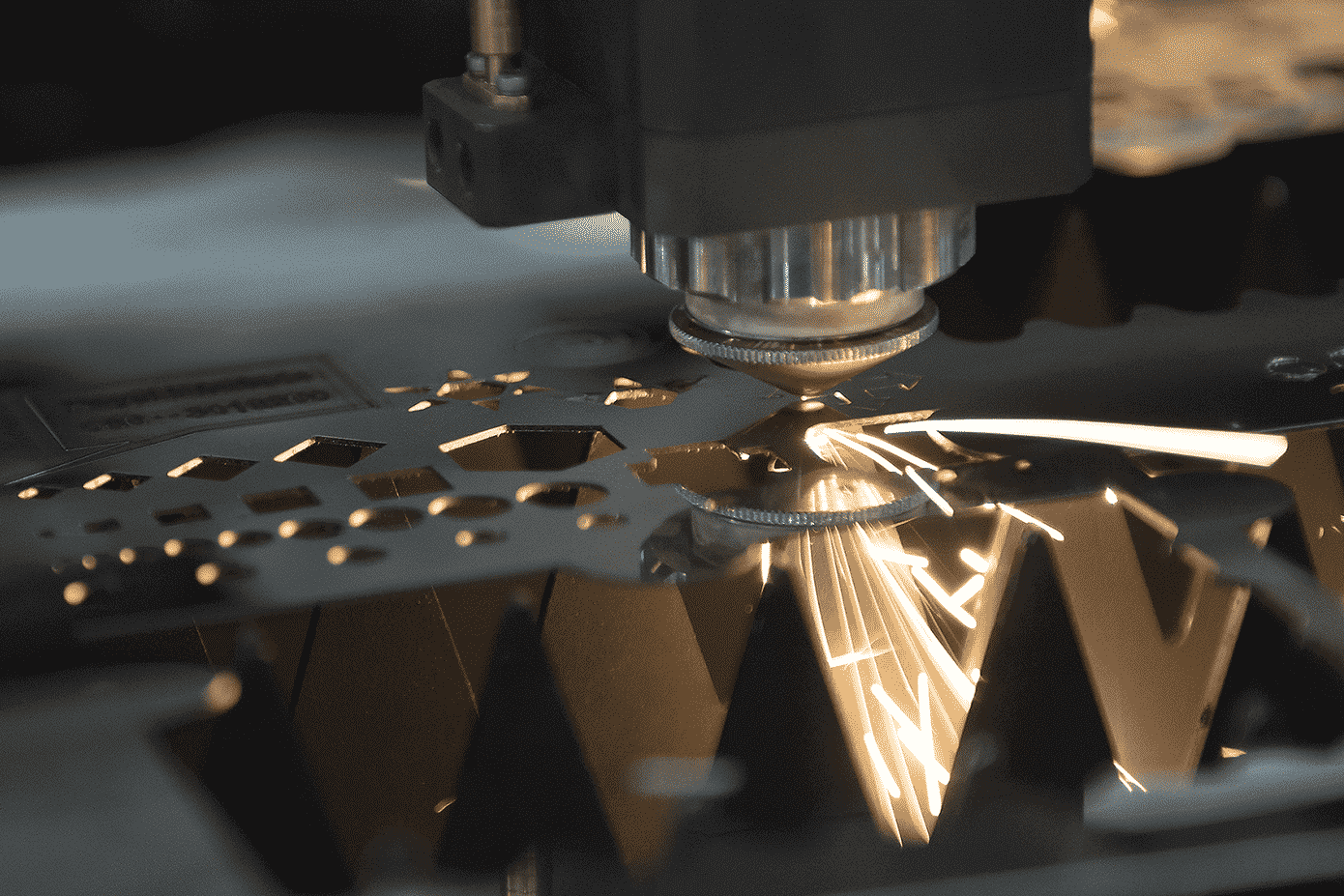

Metalwork machinery is a significant investment, the key word there being investment. The right machinery empowers your business to streamline the cost of production, automate it and do much more in a lot less time. See our “Square Wheels” blog for more information on how to speed up or automate your difficult processes.

Sometimes the actual cost of outsourcing is low, but the cost of transport can be high. This is often the case if your business is in a remote part of the UK or Europe. By bringing production in house this will also inevitably lower your carriage costs.

The cost of materials such as sheets and plates will still fluctuate. However, setting the costs of production in-house is another key reason why many metalwork manufacturers are moving towards doing more themselves than ever before.

Several of our customers have made the jump to bringing profiling in house, and remarked that they should have done this sooner. By bringing the profiling in house, the machinery has paid for itself in as little as 6-12 months. Leading to cost savings beyond that for the rest of the machine’s life.

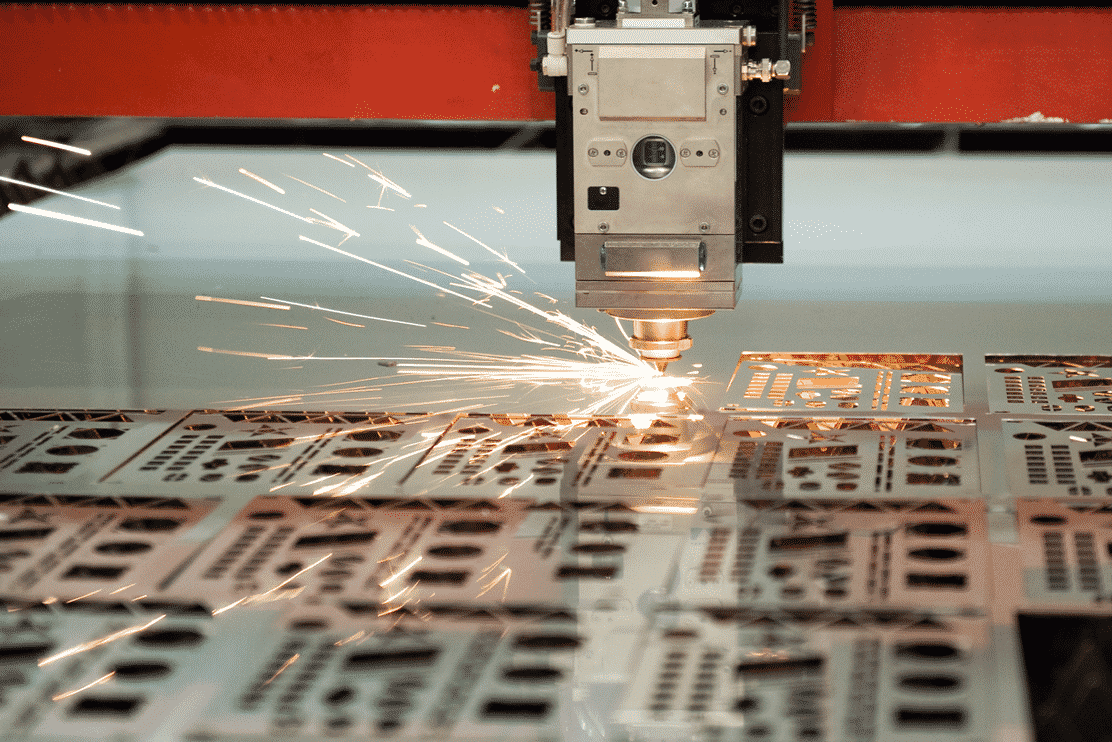

Diversification and prototyping

With the machinery for manufacturing in-house, it opens up opportunities and can lead to exploring new avenues of business. Having that ability to produce a wider range of products with more adaptable, efficient, and versatile in-house metalwork machinery is an obvious benefit too.

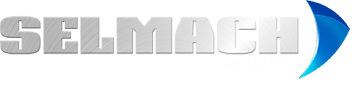

It also offers the ability to open your own business to outsourcing and undertaking work for others by becoming a subcontractor yourself. If you feel your current capacity does not justify manufacturing in-house, there is always the option to offer your capabilities to your local area. From our customer’s experiences, this happens pretty naturally as soon as word gets out that you have machinery such as a plasma or laser.

Customers manufacturing in-house

Hear from some of our customers who have purchased plasma or laser machinery from us, and how it has transformed their business.

The question of finance

The COVID-19 pandemic made cash flow a vital factor in every organisation’s plans for their short-term futures. This has been further compounded by the war in Ukraine affecting energy and steel prices across the world. This means there has never been a more important time to finance business purchases.

The positive news is that finance can be obtained for any business regardless of age, size and credit rating, with decisions often made quickly.

If you are looking to invest in metalwork machinery, there are a number of finance options available, each with slightly different characteristics.

Leasing

An agreed fixed or minimum term of rental period for an asset with regular payments for the duration of the Lease contract. At the end of the contract there is the option to purchase the machine.

Hire Purchase (HP)

An agreement to purchase the machine over a specified period. There is a small payment at the end of the agreement for ownership of the machine.

Original posted September 2020, updated July 2024.

Published 18th January 2022